How Finance Organizations Are Dealing with The Growing Demand for Instant Response Times

The financial industry is one of the most innovative industries that has evolved at an incredibly fast-paced over the past decade. Finance is a complex industry that requires a delicate balance between optimal convenience and security.

With security being the most important aspect, the role of AI has increased in importance and various financial organizations are taking strides to innovate unique solutions to meet the growing demand for faster and instant response rates.

In a recent study, it was found that automation and digital intelligence save US banks over $1trillion on an annual basis. From a world perspective, more countries in different parts of the world are adopting AI tools to meet the growing demand for instant response time.

The client experience

Despite the fast rate of digital integration into various industries, clients still want to feel a personal connection to a brand experience. The advances in machine learning have allowed for a vast improvement in personalized services using customer data. This feature uses AI tools to better understand and respond to client needs.

A feature of this nature allows financial organizations to develop improved products and increase speeds in response rates. The client not only experiences faster service but also gains access to products that are relevant to their needs and interested.

The improved customer experience has also improved by eliminating the need to go to the physical office of a financial institution to solve a problem. The incorporation of chatbots for customer service allows clients to easily solve queries remotely.

A recent example is the Bank of America’s chatbot, known as Erica, who is accessible at all times of the day is currently used by a million people. This eliminates having to deal with human assistants meaning that it is easier to access solutions. Customer service is on the areas that allow financial institutions to thrive and the client is increasingly demanding optimal customer service.

Improved security and fraud prevention

More financial organizations are making use of biometric data to record customer data. Some financial institutions have decided to replace passwords, thus simplifying client verification. Despite the simplicity, it offers a higher level of security beyond a simple pin code.

In the future, clients are anticipated to simply use their biometrics to access their funds at an ATM or the bank. Another aspect of improving response times to limit cybercrime and prevent fraud by easily identifying client patterns. The knowledge of client patterns allows clients to be contacted in the event of unusual activities.

Disruption from startup innovation

The term disruption has transformed into a positive term in the past decade because disruptors have created technology that speeds up and streamlines payments, product maintenance for clients and increasing the value chain.

Financial institutions are finding ways to work collaboratively with disruptors and innovative FinTech companies to create improved technology-driven solutions. The culture of disruption has allowed financial institutions to deliver more innovative money management solutions and simple avenues to process transactions with minimal delays.

Disruptors generally evolve at a rapid pace and are also becoming institutions that are becoming standalone financial service providers. The expanded competition only creates room for a wide range of institutions to choose from dedicated to solving client problems.

Using robotics to eliminate the risk

The growing alliance between financial services and technology companies focused on AI allows the financial industry to have a better understanding of consumer patterns to develop products relevant to them.

The joy of incorporating AI tools means that the client does not have to resort to interacting with a bank teller to solve an issue. The integration of AI tools is a good way to ensure that tasks are performed with minimal human error and eliminate hurdles that arise due to inaccuracies.

NLP AI Technology has also worked towards assisting financial institutions make informed decisions by developing different useful apps. For example, there are apps that use NLP to gather data on influencers, marketers and blog posts, that data is then used to advise financiers on how to invest. There is also other software that helps digitize financial documentation processes using NLP and that is just a few examples amongst quite a few.

Taking advantage of the sharing economy

A recent innovation in finance has been the recognition of the power of a shared economy which has been realized in industries such as transport and hospitality. The client is always looking for fast means to meet their needs and the cheapest possible options.

The rise of digital currencies and the decentralized model have shown banks that people respond to a system that allows for decentralized asset sharing.

With the rise of cryptocurrency, financial institutions have also started exploring the potential of employing blockchain to create a system that presents a public ledger and improve internal operation within an organization to deliver at high speed.

Moving infrastructure to the cloud

Financial institutions are growing more and more to use the cloud to manage their operations and this allows for easier management. Financial institutions realize the importance of automating processes such as data management, CRM, accounting and even HR.

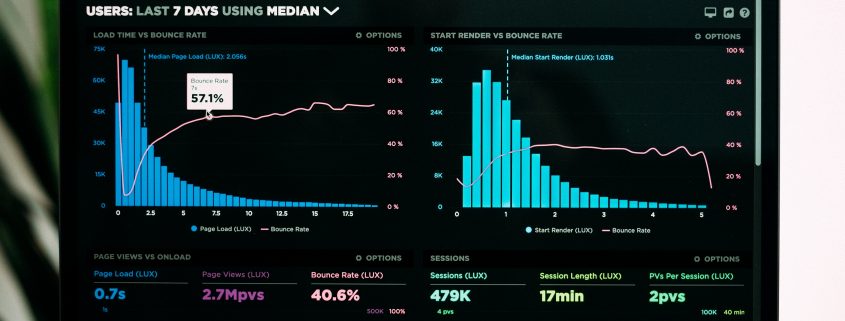

Using analytical tools allows for the fast-tracking of data gathering and delivering solutions to clients. This allows functions like client payment, statement generation, credit checks and more to become automated and more accurate.

Once again, the issue of cybersecurity is forefronted in machines ‘taking over’ and the concern stems from the fact that the software is being sourced from third parties and requirements in the industry are highly sophisticated.

The rapid growth of data-driven solutions has placed pressure on financial institutions to work with trustworthy service providers or develop inhouse data management systems to avoid third-party interactions.

Conclusion

The language of convenience is one that is universal; everyone wants everything to work faster, be delivered to their doorstep and accommodate their needs. The financial industry is no exception to these expectations from customers. Finance organizations are taking the leap into incorporating AI tools to partly manage operations because it simplifies monitoring, reporting and processing large volumes of data.

The sophistication of analytical tools ensures that issues are resolved before they become larger issues that are beyond an organization’s control. It is certainly exciting to see how financial industries and organizations will transform in 2020 to incorporate tech tools to streamline security and operations.

The Professional Certification in Business Analytics is a foundation course for students and professionals who want to develop niche data skills for their chosen industry domain or function area. Become a Business Intelligence and Data Visualisation expert and surge ahead in your career. The nine-day Business Analytics certification course covers all the essential Analytical and Statistical techniques for effective business decision making. This programme introduces the student to the basic concepts of Python language.business analytics courses